Renters Insurance in and around Joliet

Welcome, home & apartment renters of Joliet!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

It may feel like a lot to think through your sand volleyball league, your busy schedule, family events, as well as coverage options and savings options for renters insurance. State Farm offers no-nonsense assistance and unmatched coverage for your home gadgets, sound equipment and electronics in your rented townhome. When trouble knocks on your door, State Farm can help.

Welcome, home & apartment renters of Joliet!

Renting a home? Insure what you own.

Agent Jim Lacey, At Your Service

You may be skeptical that Renters insurance can help you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the house. How difficult it would be to replace your personal property can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when fires or break-ins occur.

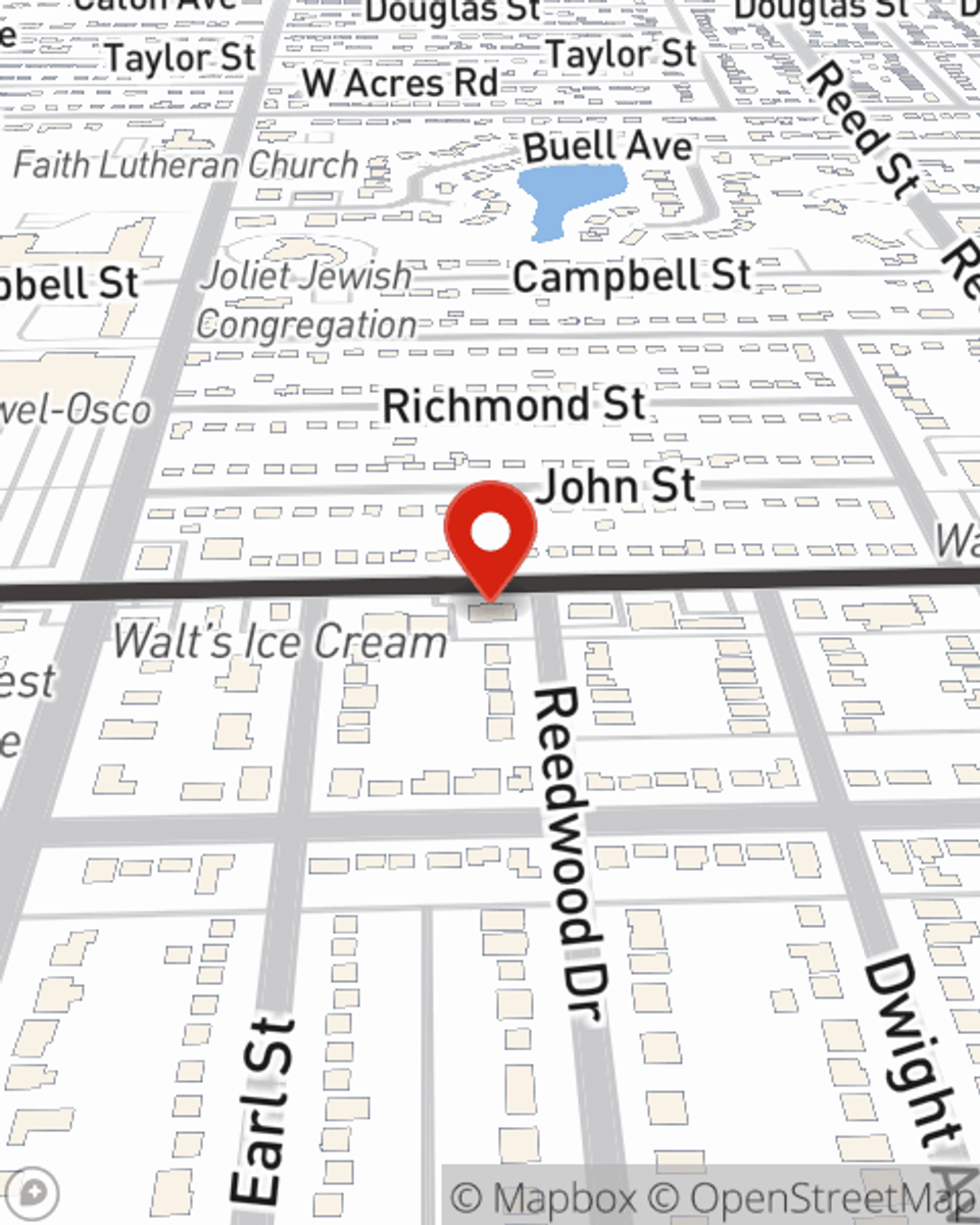

As a trustworthy provider of renters insurance in Joliet, IL, State Farm aims to keep your valuables protected. Call State Farm agent Jim Lacey today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Jim at (815) 725-4711 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.